BMO is one the largest online loan lending company. One of the loans which is preferred by almost every user is the BMO Line of Credit. Before learning details about the BMO Line Of Credit Interest Rate in September, it is important to understand what is the Line of Credit. Well, it is typically a preset borrowing limit providing the loan-providing companies to their personal and business customers.

Line of Credit can be used by entitled users at any time until the limit is hit. The www.bmo.com Line Of Credit Interest Rate is charged only on the amount which is used by the beneficiaries. It is one of the best benefits which forces users to choose the Line of Credit. In the following article, readers will learn details regarding the benefits, eligibility conditions and more.

BMO Line Of Credit Interest Rate in September 2024

BMO Line Of Credit is one of the quickest ways to get money whenever a person needs it. The company will charge interest only on the loan borrowed by the beneficiaries. For Example, if a person has a $25,000 line of credit and they only borrow $5,000, then the authorities will only charge interest on the $5,000.

Individuals need to know that credit scores could be one of the biggest factors in the application. The credit score or history of the person will tell how well the respective person has handled debt and repayments in the past. A person can met with an emergency. So, what’s better than having a good Line of Credit and getting whatever amount until it is within the specified limit?

How to apply for the www.bmo.com Line Of Credit?

Applicants who read all essential information regarding the BMO Line of Credit can go through the following section to understand the online application process. The following is the step-by-step guide to applying for a loan easily:

- First of all, search the official website of the BMO using this link address: https://www.bmo.com/

- Shortly after searching the link, the home page of the portal will open on the screen.

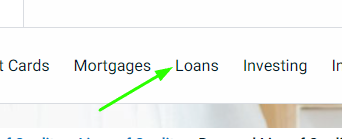

- Now, find the Loans option available among other options attached horizontally at the top of the screen.

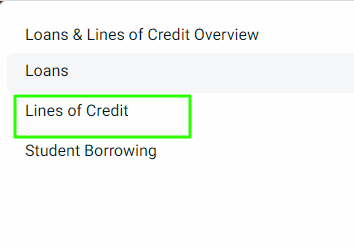

- A menu will drop on the screen where you must select the Line of Credit option.

- After that, a new page will open on the respective device.

- Read everything about the Line of Credit and click the Book An Appointment option.

- After that, talk with the respective officer and visit the nearest branch along with the required documents.

- The officials will offer the plan, submit the form, document and review the form.

- Finally, submit it to complete the application process.

$360 OTB Coming to Eligible Recipients in September 2024

Canada OAS Increase in September 2024: Check Payment Date & Eligibility

September $2600 Direct Deposit by CRA – How to get this? Check Eligibility, Dates

BMO Line Of Credit Interest Rate in September

The authority calculates the interest rate on their daily balance and charges monthly to beneficiaries’ accounts. Please note that interest rate charges on the Lines of credit is a variable one. So, it will change without providing any advance notice whenever the Prime Rate of the BMO changes.

Or else, it will change with notice according to the terms of the respective user’s Line of Credit agreement. BMO Prime Rate is also called Prime Lending Rate. The rate at which a person will get a loan or a line of credit depends on several factors including the Prime Rate. Given below are the BMO Line of Credit Prime and Base Rates:

Canada Prime Rate: 6.450 %

CAD Deposit Reference rate: 6.45 %

USD Deposit Reference rate: 5.50 %

US Base Rate: 9.00 %

Frequently Asked Questions

What documents are needed to apply for the BMO Line of Credit?

The following is the list of documents which will be needed while applying for the BMO Line of Credit:

Government-issued photo ID and Proof of employment (Like a letter from the employer, recent paystubs and recent T4/ T4A slips or RL1 if the beneficiary is a resident of Quebec, or T1 income tax return or Revenue Quebec TP1 with corresponding notice of assessment)

What is the BMO Line Of Credit Interest Rate in September 2024?

The interest rate depends on the amount borrowed by the eligible beneficiaries. Along with the prime rate, credit score and other factors are considered while calculating the interest rate.

Can I apply for the www.bmo.com Line Of Credit offline?

Individuals who do not want to get confused with the online process can simply visit the nearest BMO office and apply for the Line of Credit offline.

What are the benefits of the BMO LOC?

Some of the benefits include it can be used anytime, one can keep reusing it and more.